Denied Medicare Advantage Claims

Medicare Advantage plans have been improperly denying many medical claims and refusing to pay, putting profits before patients' well-being. That is the story that hit the major news feeds following an HHS report that came out in September 2018.

Motives sinister or not

The motives for denying medical claims may not be as sinister as many people think. But there is a disturbing pattern that strongly suggests the possibility that claims are being denied with the expectation that few people will actually file an appeal.

♦ Medicare Advantage plans are a popular alternative to traditional Medicare.

The plans offer potential advantages, including a doctor who can coordinate care. Private plans have an annual limit on out-of-pocket expenses; traditional Medicare does not.

♦ The plans now cover more than 20 million people. This represents about one-third of all Medicare beneficiaries. Experts predict that these plans will be coving one-half of all Medicare patients by 2021.

The Department of Health and Human Services (HHS) which oversees the Center for Medicare and Medicaid Services (CMS) encourages people to enroll in Medicare Advantage plans.

The Trump administration has taken a favorable view toward Medicare Advantage plans.

• The administration approved an increase in payments to plan sponsors. The tax cuts passed by Congress in 2017 give health insurers additional tax breaks. Congress also suspended a fee imposed on insurance companies by the Affordable Care Act.

♦ Unfortunately, the way the Medicare payment system is setup, insurance companies that administer these Advantage plans have a financial incentive to deny claims.

The insurers are paid by CMS a monthly fee per member. If the cost of providing care is less than the fee, the insurer keeps the balance.

Insurers may also receive a bonus for keeping costs down and for meeting quality of care standards. An insurer can also be penalized and lose money if they fail to provide the care they are supposed to. But very few insurers receive more than a slap on the wrist for questionable actions.

• The dilemma is that insurance companies participate in this market to make a profit. The more they approve for payment the more their profits can be affected.

The current model can only work if payouts are rare. This is hardly the case when it comes to the needs of the elderly and chronically ill patients.

♦ The Inspector General of HHS issued a report in September of 2018 that goes into great detail about the number of medical claims that were denied by Medicare Advantage plans. The report casts doubt on Advantage plan administrators’ motives for denying claims and their willingness to help beneficiaries appeal denials.

• The report adds to the perception of guilt that the industry has cultivated over a long time.

For years, insurance companies used tactics like charging astronomical premiums or denying coverage to people with pre-existing conditions all in the name of protecting profits. This is a legacy that will not go away.

The report

The Department of Health and Human Services (HHS) reviewed data collected by Medicare from 2014 thru 2016. They looked at the number of denied claims. And the number of appeals that were filed. They found too many denials along with too few appeals.

As part of the review, they looked at 448 million requests for payment made in 2016. Preauthorization requests were 24 million with 4 percent (about 600 thousand) being denied. Requests for payment for services already received were 424 million with 8 percent (about 34 million) being denied.

♦ The report states that the percentage of denials is disturbing and suggests further investigation is needed.

The review highlighted the fact that less than 1 percent of patients or providers appealed these denials. This leads one to wonder why.

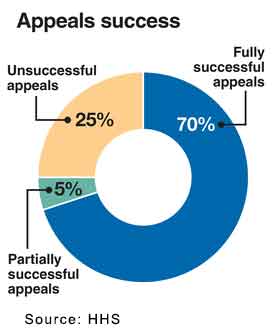

♦ Of the claims that were appealed, the majority (close to 75 percent) were either paid in full or partially. This point should stand out as encouragement to everyone to not give-up, APPEAL.

The report went on to state concerns about the high overturn rate of appealed denials.

♦ They report that there were widespread and persistent findings about inappropriate denials.

This raised concerns that “some Medicare Advantage beneficiaries and providers were denied services and payments that should have been provided. This is especially concerning because beneficiaries and providers rarely used the appeals process designed to ensure access to care and payment.”

♦ The report notes that there is “the potential incentive for insurers to inappropriately deny access to services and payment in an attempt to increase their profits.”

In 2015, CMS found that 56 percent of Advantage plans made inappropriate denials. CMS also found that 45 percent of Advantage plans sent out denial letters with incomplete or incorrect information, which may have inhibited beneficiaries’ and providers’ ability to file a successful appeal.

• Advantage plan administrators must issue denial letters that clearly explain why requests were denied and how the beneficiary or provider can file an appeal.

CMS found that some denial letters did not clearly explain why a request was denied, contained incorrect or incomplete information, did not use approved language, and/or were written in a manner not easily understandable by the beneficiary.

• Failure to issue sufficient denial letters can impair a person or provider’s ability to mount a successful appeal and can result in delayed access to care, and/or financial hardship.

Insufficient denial letters may be one reason that the appeal rate is so low for Medicare Advantage plans. Many times, these letters go to people who may be overwhelmed with medical issues or out-of-network providers who may be unfamiliar with the plan’s appeal process.

Reasons for denial

Profit is not the only reason for a denial, but it is a good one. The authors of the HHS report seemed especially concerned about this.

The Medicare Advantage plan sponsor is tasked with approving a claim and Medicare with paying it.

• In some cases, a decision may have been based upon the information available at the time. And if that information was insufficient the claim would be denied.

This type of denial is by far the most common and also the easiest to overcome. Appeal the decision and provide the information needed for approval.

• Some plans do not pay for care provided by a specialist unless the beneficiary was referred by an in-network provider. In these cases, the plan may deny the initial request for payment if the referral is not documented.

This type of denial is easily overturned upon appeal after you show that you did have a referral. Of course, if you forgot to get a referral it will be a bit tougher but still you should file an appeal and ask them to reconsider paying.

♦ Overturned denials do not necessarily mean that plans inappropriately denied the initial request. Each overturned denial represents a case in which beneficiaries or providers had to file an appeal to receive services or payment that are covered by Medicare.

The CMS is concerned that, the extra step of filing an appeal creates a burden for patients and providers. This may be especially burdensome for people with urgent health conditions.

♦ Although overturned payment denials do not affect access to services for the effected patient, the denials may impact future access. Providers may be discouraged from ordering services that are frequently denied — even when medically necessary — to avoid the appeals process.

When beneficiaries and providers chose not to appeal denials, the beneficiary may have gone without the requested service, the beneficiary may have paid for the service out of pocket, or the provider may not have been paid for the service.

In summary

A denial for payment or services is never final until you have exhausted all your rights to appeal. And appeal you should.

♦ The odds are heavily in favor of winning an appeal on the first try. A 75% success rate is pretty good.

You should expect that your insurer is not likely to give you clear information. At some point you will need to push for more clarification.

You must have a clear detailed reason for a denial of a claim or service. And you must be told clearly the procedures to follow to submit an appeal.

♦ The insurance company expects most people will give-up, because the data shows that they do. But you must not give-up.

The appeal process for Medicare Advantage claims consists of four levels. It sounds complicated but with patience you can get through the process.

♦ It is most likely that you will succeed at the first-level and never have to appeal further.

There is a separate article on the appeal process. We encourage to spend some time reading Medicare Advantage Appeals Process.